Curious About Starting Profit First?

Profit First is a powerful system, but it can feel daunting to begin. Watch the video above, or, read the transcript below to learn the 3 quick easy steps you can take to start Profit First in your private practice.

Profit First = Overwhelming

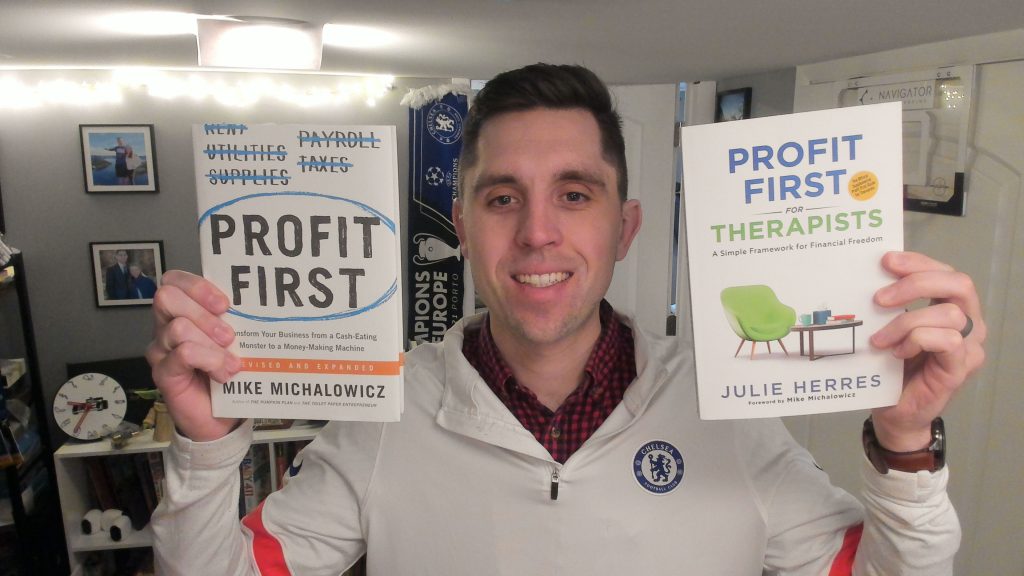

Hey, it's Nate from Navigator Bookkeeping, and I'm here today to talk to you about three easy steps you can take to implement Profit First in your private practice or group practice. So you are a practice owner, and you've read Profit First, or maybe you've read Profit First for Therapists, both great books, both great reads. But what we've seen with a lot of clients is these can be very overwhelming, right? You've been managing your money, doing your thing in your normal process and all of a sudden, you read this book and it tells you, hey, everything that you know, we want you to do it differently.

We want to have all these bank accounts. We want you to make all these transfers. And that can feel really overwhelming, right? Because you're like, well, my system's been okay. It's not great. I want some change to happen.

But moving to a whole new system where I have money in multiple bank accounts, I have to make these transfers. How often do I make those transfers? What are the amounts on those? If you're trying to just do that all on your own, it can feel like a lot, feel pretty overwhelming. So I'm gonna give you a structure to use to start Profit First now.

Now this is not gonna get to full implementation of Profit First, but what it's gonna get you to, is on the road to that, and it's gonna get you to hitting those savings goals sooner rather than later. I always think with Profit First, let's just start now and get moving, rather than sitting in inaction and not getting anything done and not building our savings, right?

A Different Way of Getting Started

So we're not just gonna start out a 100% pedal to the floor, go right away, but we're at least gonna get started and we're gonna do it in a little bit more of a manageable way, a way that maybe feels a little bit more doable, manageable. And it's gonna start building your savings now, and get you into the Profit First mindset so that as you go, you can get into the Full Profit First implementation as well.

I run Profit First for My Business Navigator Bookkeeping. We're a Profit First certified firm. We run it with many of our clients. So I'm giving you tips that we've used with these clients, and I love Profit First. Like I said, I've been running it in my own business. I love it. I think it's a great system. So I think you should try it. I think you should use these three steps to get started on it, and see how you feel about it, and then you can go from there.

Step 1 - Pick Your Bank Accounts

So here's the three steps. The first step is you're gonna open your bank accounts. And if you read Profit First or Profit First for Therapists, this is the same step number one that they would have you do. You're gonna want to pick a bank that's gonna have a probably no minimum fee. So basically, these accounts are gonna get down to zero at times or close to zero. You don't want a fee to come in if you're below a minimum balance.

So that's kind of the first option. Try to find a fee free bank. And with interest rates where they are right now, I'm talking to you at the beginning of 2024, interest rates are pretty high in savings accounts. You probably wanna find an account that has a decent savings interest rate as well. Now, that should not exclude banks just because they have a lower interest rate, but just something to think about.

QuickBooks checking is a relatively new system. They're offering 5% interest right now, and they have been for a while. So you could find a bank like that that's virtual only and makes transfers easily. It has some odd wrinkles to it to be honest, but it does give you 5% interest of something to check out.

Otherwise, you can check out Relay, which is an online only bank which is the official bank of Profit First, so it works well with that system. Or you can just go with your current bank that you're using, whether that's kind of a big box bank like a Chase or whether it's a local bank as well. So you're gonna set up those bank accounts.

Now, if you're reading Profit First, you're gonna set up five bank accounts. With what I'm talking to you right now, we're just gonna set up two to three instead. We're gonna go a little bit slower, okay? We're just gonna start slow, and go from there. So you're just gonna open two to three accounts. And what these accounts are gonna be is they're gonna be your profit account, your tax account, or what we'd call your tax savings account, and then an emergency savings account as well.

And we're gonna start that with those three, just to get us building the savings muscle, and getting into the Profit First mindset. Again, this is not a full Profit First implementation, but what I've seen with clients is that oftentimes, starting slow and building up is a lot better system than just going full into it and getting overwhelmed and then quitting because it's a tough system to get used to.

So we're gonna open those three accounts, profit, tax and emergency savings. In Profit First language, we'd call that emergency savings vault. So you can call it vault if you want. You can call it emergency savings if you want. It doesn't really matter. We're gonna open those first step, easy, okay? It might be annoying to talk to the bank. It's okay. If you don't like talking to people, do the virtual Relay or QuickBooks checking, go that route.

Step 2 - Begin the Transfers, Get Muscle Memory

Number two, step number two. We're going to just start doing some transfers just to get into the mindset, get into the muscle memory of doing it, okay? So what I would advise you to do is to start with a really small percentage of your revenue going into these accounts. So that can be 1%. You could even do a half percent, but I think one is nice. It's easy, the math's easy. It's very straightforward.

So what you're gonna do is at the end of every pay period, or you can do at the end of either of every month. It doesn't matter how often you wanna do it. For a lot of private practices, it does make sense to do it with kind of the pay period structure, because then, after you've paid everybody, you're kind of doing these transfers at the same cadence.

So let's say you're doing it every two weeks, right? Pay period structure. So what you're gonna do is for those two weeks, you're gonna figure out how much money came into the business, as far as what was just deposited in your account. So you can go to your bank and just run a quick filter and figure out how many deposits we can have.

You can go super low tech and just count up your deposits in the bank feed from your bank's website, or if you run a reporting QuickBooks, as long as everything's classified correctly, you can find in there pretty easily what your deposits looked for for that period of time. So you're to find out what your deposits are. Let's just to make it super easy, let's just say that you had a $1000 in deposits, okay? Very easy.

Probably not what you're shooting for, but we're just talking easy math here, okay? You can use 10,000 for your example instead if you want to make it easy. So we're gonna take that $1000 and now we're gonna say, okay, we want 1% of $1000 to go to our tax. We want 1% of $1000 to go to our profit, and we want 1% of $1000 to go to our vault/savings. Okay? So you're gonna make those transfers happen. You can just transfer it between your banks. You've now done your first transfers. It's that easy.

Now, what I would say is you should record what you've done. So just have a really simple spreadsheet and just on the left say pay period and then just have your three accounts and just write out how much you transferred each of those, each pay period and just keep track of it.

Accounts to Begin With

And what you're gonna use this for is this is going to help us kind of see your progress, see how much you've saved over time. And you're just gonna repeat this process every two weeks or whatever your pay period structure is. Or like I said, some people do this monthly, so you can do it monthly, but you're just gonna do this. Keep sending that 1% aside into these different accounts and what you're gonna see, it's not gonna be a lot of money unless your practice is large.

But what you're gonna see is you're gonna see those accounts growing pretty fast, right? Before you had nothing in savings. Now you have a couple of $100 in a couple different accounts, and that's building up fast. And what that's doing is that's changing your mindset, right? Because if an emergency happens now, if a clinician leaves, if referrals drop off, something like that happens, you have savings built up that can help you out. That vault account can come in and cover your operating expenses for a short period of time. If you have a tax bill come up or you're ready to pay your estimates, that tax account can pay those estimates for you.

The profit account, that's half savings and it's half a bonus for you. What are you gonna do with that account is every quarter after the quarter finishes, you're gonna take half of that profit account and distribute it out to yourself as a bonus. So quarters, right? January, February, March, as soon as March is done, April 1st. You're gonna take half of that profit account, send it to yourself. And what you're gonna do with that money is you're gonna do something fun with that money.

You're not gonna put it back into the account. You're not gonna pay some bills unless things are urgent. That's, if you got to do what you got to do. But you're gonna do something fun with that to reward yourself for implementing Profit First, to reward yourself for taking the risk of running a business, okay?

We've had clients make that their vacation fund, right? So they use that money, they went on a vacation with that money and they got to go on a great vacation that they would not have been able to afford or felt like they could afford before that, right? Me personally with my profit account, I've done some silly things. I bought an espresso machine, make espresso for our family every morning with that. I make lattes. Did I need that? No, but it was a super fun thing that's added a lot of joy and hospitality to our house.

You can do all kinds of things with that, travel, go out to a nice dinner, whatever you wanna do, but don't just put it towards bills. Do something that's memorable that you're gonna remember. So you think, wow, that profit account funded that, my business funded that, because I did Profit First. You wanna feel that reward and see that reward, and that's gonna help you get motivation to keep going in the system.

Step 3 - Analyze Your Transfers & Percentages

So step one, open the bank accounts. Step two, start the transfers, do that 1% overtime, track it and see how it goes. And then step three, we're just gonna kind of analyze where we are. Now, you can do this with a Profit First certified firm.

They can do a little bit of a more formalized assessment. But if you're watching this, I'm guessing you're kind of like, hey, I'm just gonna DIY this right now. Do it yourself. Okay? I was like, did I do the acronym wrong there? No, DIY. You're in DIY, and you're just gonna watch it, see the transfers happen and see where you go. And what you're gonna do is you're gonna kind of see how does this 1% feel?

Do I feel like these accounts are kind of growing slowly, right? You're eventually gonna want that tax account to cover all of your estimated tax payments and cover your year end tax payment as well. So that tax account's gonna need to be a little bit more robust. One percent's not gonna do it.

You might need that account to get all the way up to 10%, 15%, somewhere around there at some point, depending on your practice. That profit account, we're gonna want that to get up to 5% of it eventually. So that account is growing and building savings, and you're getting great distributions out of that quarterly. And that vault account, we're gonna want that to be somewhere probably between 2% to 5% depending on your business.

We're eventually gonna want that to have at least three months of your operating expenses and your payroll in it, so that if something happens, you have time to make a decision. You're not rushed into making that, but you're ready to go. You lose three clinicians at the same time for some crazy reason, cool. We have three months of payroll saved up. That gives us time to hire at least some of those positions back and make some decisions instead of rushing to a line of credit or to a credit card right away.

Try It Out!

So that's where we're trying to get to eventually, right? And these three steps are gonna get you there. These are all easy to do. Open the bank accounts, start making the transfers, and then track and analyze those transfers that you've done, and just see how it feels and think about it. Just every month, take a look at that, see how do I feel about this 1%? It's kind of going slow. Maybe I wanna bump it to 2% or vice versa. Let's say you bumped it up kind of fast, you're at 5%, you're like, cash is kind of tight in this operating account. I need to bump this down a little bit.

And again, this is where it is nice to have a conversation with somebody else who knows Profit First. But this is the beginning, right? This is where we're starting, and then as you grow and as you build, maybe you would get up to that point where now you start working with someone who can consult with you and answer some of those questions.

But if you're not starting this, you're never gonna get up to that next phase. So these are the first three steps. Start these out, see how they feel, and let us know in the comments how this went. Let us know how you felt. Let us know how it felt to take that First Profit distribution, and I think you're gonna really like this. I think it's gonna change how you think about Profit First and think about your business. So I'm excited to hear how this goes. And good luck with Profit First.